New FAFSA Favors Grandparent College Giving

Helping a grandchild obtain a college degree could be a lifelong gift, but grandparent giving has often required fiscal gymnastics to avoid reducing a student’s financial aid eligibility. That is changing with the 2024–2025 Free Application for Student Aid (FAFSA), which opens in December 2023. The changes apply to any gifts from grandparents, including distributions from grandparent-owned 529 plans, which offer tax-free growth when funds are used to pay a beneficiary’s qualified education expenses.

Distributions and Gifts No Longer Counted

Under the old rules, grandparent gifts and grandparent-owned 529 distributions were counted as untaxed student income and assessed at 50% when calculating student resources, which would typically reduce a student’s financial aid award. The new FAFSA will no longer include a question about gifts from grandparents and will draw student income information solely from the student’s tax return, which would not include gifts or 529 distributions.

This means that grandparents will be able to help with their grandchild’s college expenses without affecting the student’s eligibility for financial aid based on the FAFSA. Keep in mind, however, that grandparent gifts and 529 distributions will likely continue to be counted by the CSS Profile, an additional aid application typically used by private colleges when distributing their own institutional aid.

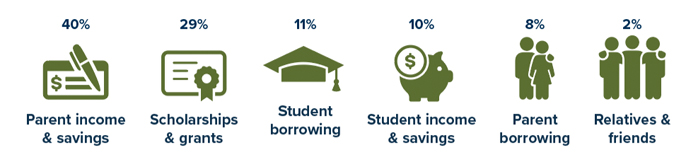

A Family Project

Here’s how the typical family paid for college during the 2022–2023 school year

Source: Sallie Mae, 2023

The FAFSA uses a two-year “look-back” period for income, so the 2024–2025 FAFSA will be based on the student’s 2022 tax return. Thus, a grandparent gift or distribution in 2022 won’t affect the 2024–2025 FAFSA, and the same treatment will apply to gifts and distributions in 2023 and later years.

Consider the investment objectives, risks, charges, and expenses associated with 529 plans before investing. This information and more is available in the plan’s official statement and applicable prospectuses, including details about investment options, underlying investments, and the investment company; read it carefully before investing. Also consider whether your state offers a 529 plan that provides residents with favorable state tax benefits and other benefits, such as financial aid, scholarship funds, and protection from creditors. Generally, there are fees and expenses associated with participation in a 529 plan. There is also the risk that the investments may lose money or not perform well enough to cover college costs as anticipated. For withdrawals not used for higher-education expenses, earnings may be subject to taxation as ordinary income and a 10% federal tax penalty.